Clause (ii) of sub-section (2) of section 2007

And whether you're an honest man, or whether you're a thief, depends on whose solicitor has given me my brief. - Benjamin Franklin.

NEWS YOU CAN USE : The income tax department has gone “e”.

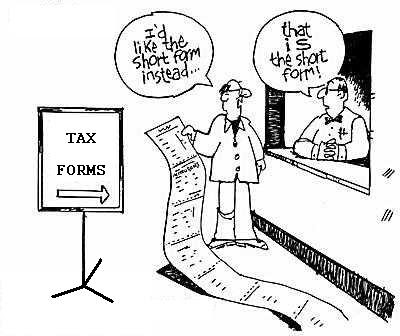

Now one can file tax returns sooooo conveniently just by downloading the appropriate form ( if you can figure out which ones pertain to you) and use the return preparation software.

Then when you are all confused about how to use the software, or if you have any questions about a particular tax loophole, you may call the toll-free tax helpline number closest to you and listen to the engaged tone until you feel you have a clearer understanding of how helpless you really are and need to now contact a chartered accountant.

There are not many changes in the new tax form, only about 957 significant disallowed expenses. But the good news is :

1. Santa Singh is still the commissioner of income tax.

2. The P.A. to the Assistant Undersecretary of Poverty relief is changing the upholstery in his new office, which costs more than your annual salary, and the government now finding itself in serious debt, also exhorts you to send in “voluntary contributions”.

You are not required to send in more money than what you actually owe.

You can also send in gold, jewellery, clothing or accessories. Santa Singhs’ shoe size is an 8.

When filling in your tax return form this year please remember to avoid the following errors:

When writing up fictitious numbers please use figures that sound plausible such as Rs. 9847.45 instead of the more obviously telltale amount of Rs.10000.00.

Remember that tax officials scrutinise returns even more closely when taxpayers names sound like Dawood Abraham, Harshad Mehta or Rakhee Sawant.

Now for some tax case studies and how they should be handled under the latest tax laws, regardless that it states that this is referred to as the INCOME TAX ACT 1961*.

CASE NUMBER 1 : MLA Shri Sachananda Bihari Jha established a trust for his 9 children where each of them when they turn 18 will receive a Mercedes Benz and 5 villages.

When beating up his bonded labourers 12 year old son one day he vaguely recollects having bought some contraband cattle fodder.

QUESTION: What should Shri Jha do?

ANSWER: He should immediately summon his party workers and his press secretary to place ice-packs on his forehead and soothe him until he can be named to replace Ronen Sen as ambassador to the US.

CASE NUMBER 2 : Shri and Shrimati Bholaram are a working couple with 2 dependant school going children and a gross total annual income of Rs.2,30,000.00.

During the first financial quarter they received a tax notification that according to the e-governance income tax computer they owed Rs. 10 Crores as taxes.

Laughing at the huge blunder the income tax Department had obviously made and how they would be interviewed by NDTV as victims of typical government lassitude they show this to their friends and neighbors.

QUESTION: Can the Bholarams deduct the cost of the orphanage where they admitted their children while they were interred in debtors prison for four years?

ANSWER: They may deduct 33 percent of the amount spent on food for the period after adjustment to allow for the inflatable index, up to but not greater than Rs.2580.00, provided they maintained accurate records.

ANSWER: They may deduct 33 percent of the amount spent on food for the period after adjustment to allow for the inflatable index, up to but not greater than Rs.2580.00, provided they maintained accurate records.

CASE NUMBER 3 : Shrimati Ulaganathan, 71 years old, living on her railway pension with no other income, receives a phone call while asleep one night where she discovers she might have an illegitimate son. Shocked, she dies of a heart attack.

QUESTION: Does Shrimati Ulaganathan still have to file a tax return?

ANSWER: Yes. Don’t be stupid. She should use Form ITR-12 Individual and Deceased Person, which can be obtained from the Income Tax Customer Relations Centre on any working day between 9am and 12 noon.

ANSWER: Yes. Don’t be stupid. She should use Form ITR-12 Individual and Deceased Person, which can be obtained from the Income Tax Customer Relations Centre on any working day between 9am and 12 noon.

Finally and sadly, I have received word of the deaths of my chartered accountant at the tender age of 46, and 48 hours later my foster dad who was ailing also passed away.

It is hard, at such a time of tragedy to find words to express my feelings, but I speak for all of us when I quote Benjamin Franklin once again who said “In this world nothing is certain but death and taxes.”

On a more upbeat note he also said, “I look upon death to be as necessary to our constitution as sleep. We shall rise refreshed in the morning.” We can't say the same for taxes, that's for sure!